Asian markets were trading lower. China’s Shanghai Composite was down 0.48% or 9.92 points at 2,068.58.

Asian markets were trading lower. China’s Shanghai Composite was down 0.48% or 9.92 points at 2,068.58.- Japan’s Nikkei was flat at 9,163.77.

- Singapore’s Straits Times was down 0.25% or 7.58 points at 3,071.14.

- South Korea’s Seoul Composite was down 0.21% or 4.16 points at 1,998.19.

- Taiwan’s Taiwan Weighted was down 0.42% or 32.80 points at 7,729.42.

- Hong Kong’s Hang Seng was up 0.16% or 32.58 points at 20,690.69.

- The US markets snap a four-day rally, pulling back from Fed-fueled multi-year highs, amid fresh geopolitical worries and following a sharp drop in oil prices. Despite the day’s pullback, all three major averages are still up more than 3% for the month.

- Dow Jones Industrial Average was down 0.3% or 40.27 points at 13553.1. Nasdaq Composite was down 0.17% or 5.28 points at 3178.67. Standard & Poor’s 500 was down 0.31% or 4.58 points at 1461.19.

- In stock specific action Apple crossed USD 700 a share in after-hours trading after closing at a new all-time high after the company said iphone 5 sales set a record over the weekend.

- On economic data front, factory activity in New York state contracted for a second month in a row in September, falling to its lowest level in nearly 3-1/2 years as new orders shrank further.

- In key data to watch out for in US today, housing market index is expected to rise to 38 in September.

- In the currency space, the dollar hovers around 7-month lows against a basket of major currencies. The dollar index was below the 79 mark.

- In commodities, Brent crude slipped to USD 111 levels in 3 minutes yesterday. It pares its losses to trade back above USD 114. In the meanwhile the US commodity futures trading commission is looking into the reason for the fall.

- From the previous metals space, gold prices slip marginally to USD 1760 levels.

- Indian ADRs ended lower on Monday. In the IT space, Wipro was down 0.78% at USD 8.92, Patni was down 0.21% at USD 19.06 and Infosys was up 0.08% at USD 48.19.

- In the Banking space, HDFC Bank was down 0.32% at USD 37.02 and ICICI Bank was up 2.38% at USD 39.1. In the Telecom space, Tata Communication was down 1.22% at USD 8.88 and MTNL was down 2.04% at USD 1.44.

- In the other space, Sterlite was up 0.13% at USD 7.69, Tata Motors was down 1.61% at USD 25 and Dr Reddys was down 2.83% at USD 30.93.

Market cues:

- FIIs net buy USD 522 million in cash market on Sep 14

- MFs net sell Rs 202 crore in cash market on Sep 14

- As per provisional data of September 17, FIIs were net buyers of Rs 2252 crore in cash market. FIIs were net buyers of Rs 1976 cr in F&O. DIIs were net sellers of Rs 838 cr in cash market.

F&O cues:

- Nifty options suggest market range of 5400-5700

- Total Puts add 42.4 lakh shares in Open Interest

- Total Calls adds 10.3 lakh shares in Open Interest

- 5800 Call adds 22 lakh shares in Open Interest

- 5700 Call adds 7.7 lakh shares in Open Interest

- 5600 Put adds 11 lakh shares in Open Interest

- 5500 Put adds 9 lakh shares in Open Interest

- 5600 Call sheds 14 lakh shares in Open Interest

- Total Nifty Futures added 12.3 lakh shares in OI

- Stock Futures adds 62.2 lakh shares in OI

- Nifty PCR rose to 1.1 from 1.03

- India VIX closed at 17.78 up by 15.6%

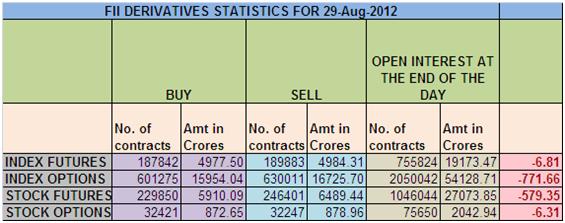

- FIIs in F&O on Sep 17

- FIIs net buy Rs 1122 cr in Index Futures; Index Futures Open Int contracts up by 21420

- FIIs net buy Rs 541 cr in Index Options; Index Options Open Int contracts up by 118440

- FIIs net buy Rs 428 cr in Stock Futures; Stock Futures Open Int contracts up by 11715

Nifty Future made a fresh September series high today at 5453. IIP data came at 0.1 which is as per market expectation. Another important Global event German Court gave in favor of using ESM and Germany Can Ratify ESM Fund with Conditions so nothing is stopping Bulls. Always remember hot money chase the momentum and in liquidity driven rally fundamental will take the back seat. So do not waste your time in finding top and bottom, Stay with trend and mint money.

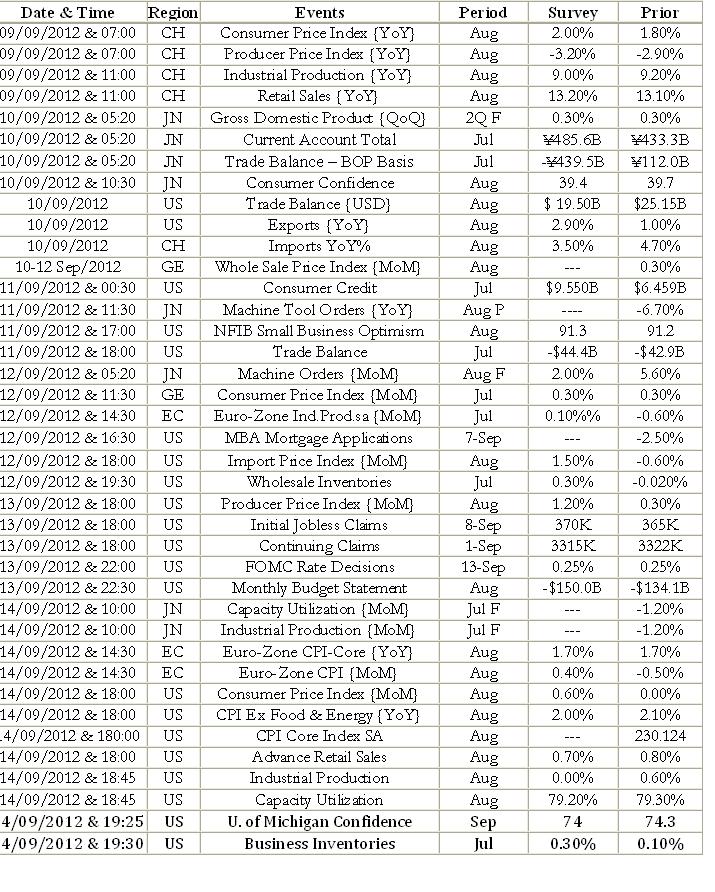

Nifty Future made a fresh September series high today at 5453. IIP data came at 0.1 which is as per market expectation. Another important Global event German Court gave in favor of using ESM and Germany Can Ratify ESM Fund with Conditions so nothing is stopping Bulls. Always remember hot money chase the momentum and in liquidity driven rally fundamental will take the back seat. So do not waste your time in finding top and bottom, Stay with trend and mint money. Advance tax data for Q2 September 2012, policy meeting of the Federal Open Market Committee on US interest rates and mid-quarter policy review by the Reserve Bank of India (RBI) will dictate near term trend on the bourses.

Advance tax data for Q2 September 2012, policy meeting of the Federal Open Market Committee on US interest rates and mid-quarter policy review by the Reserve Bank of India (RBI) will dictate near term trend on the bourses.

The Bse Index put up the lid at 17384 down 45 points or -0.26% and Nifty Shut Stop at 5254, down 5 points or -0.09% from the previous close. CNX Midcap index was up 0.1% and BSE Small cap index was gained 0.2% in Yesterday’s Trade. The market breadth was positive with advances at 780 against declines of 635 on the NSE.

The Bse Index put up the lid at 17384 down 45 points or -0.26% and Nifty Shut Stop at 5254, down 5 points or -0.09% from the previous close. CNX Midcap index was up 0.1% and BSE Small cap index was gained 0.2% in Yesterday’s Trade. The market breadth was positive with advances at 780 against declines of 635 on the NSE.