The US markets ended narrowly mixed in lackluster trading, with the Dow breaking a four-day winning streak, as investors digested a better-than-expected jobless claims report against waning optimism over the ECB to tackle the region’s debt crisis. Nevertheless, the 5 day rally on the S&P 500 has helped it move nearly 10% higher from the lows of early June.

The US markets ended narrowly mixed in lackluster trading, with the Dow breaking a four-day winning streak, as investors digested a better-than-expected jobless claims report against waning optimism over the ECB to tackle the region’s debt crisis. Nevertheless, the 5 day rally on the S&P 500 has helped it move nearly 10% higher from the lows of early June.- Dow Jones Industrial Average was down 0.08% or 10.45 points at 13165.19. Nasdaq Composite was up 0.25% or 7.39 points at 3018.64. Standard & Poor’s 500 was up 0.04% or 0.58 points at 1402.8.

- On economic data front, weekly jobless claims unexpectedly fell last week, slipping 6,000 to a seasonally adjusted 361,000. Trade deficit narrowed in June as lower oil prices curbed imports. And wholesale inventories in June posted their steepest decline since September.

- In key data to watch out for in US today, data may show that export prices declined by 0.1% versus the 1.7% plunge in June. Meanwhile, import prices could see a 0.2% rise for the month of June.

- In the currency space, the euro slips below 1.23 to the dollar as traders booked profits on recent gains.

- In commodities, crude prices gain with Brent above USD 113 levels lifted by stronger-than-expected economic data in the US and a lower outlook for North Sea Brent production.

- From the precious metals, gold prices gain on fresh stimulus hopes in China.

- Indian ADRs ended mixed on Thursday. In the IT space, Patni was up 0.79% at USD 18.6, Infosys was up 0.34% at USD 41.59 and Wipro was up 0.25% at USD 8.07.

- In the Telecom space, MTNL was up 2.54% at USD 1.21 and Tata Communication was down 1.49% at USD 8.58. In the Banking space, HDFC Bank was up 0.06% at USD 35.32 and ICICI Bank was down 0.4% at USD 34.97.

- In the other space, Sterlite was up 3.1% at USD 7.99, Dr Reddys was down 0.73% at USD 29.9 and Tata Motors was down 3.57% at USD 21.34.

F&O cues:

- Nifty options suggest market range of 5200-5400

- Total Puts add 6.7 lakh shares in Open Interest

- Total Calls add 17.6 lakh shares in Open Interest

- Highest OI buildup seen in 5000 Put & 5500 Call

- 5000 Put sheds 94K shares in Open Interest

- 5500 Call sheds 3.7 lakh shares in Open Interest

- 5400 Call adds 6.3 lakh shares in Open Interest

- 5300 Put adds 1.8 lakh shares in Open Interest

- 5100 Put adds 1.1 lakh shares in Open Interest

- Total Nifty Futures added 3.3 lakh shares in OI.

- Stock Futures adds 93.3 lakh shares in OI

- Nifty PCR fell to 1.15 from 1.17.

- India VIX closed at 16.33 down by 0.24%

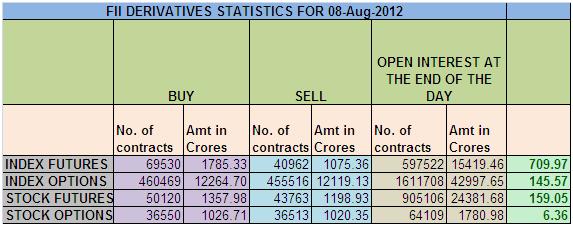

- FIIs in F&O on August 09

- FIIs net buy Rs 27 cr in Index Futures; Index Futures Open Int Contracts up by 15419

- FIIs net buy Rs 438 cr in Index Options; Index Options Open Int Contracts up by 42998

- FIIs net sell Rs 331 cr in Stock Futures; Stock Futures Open Int Contracts up by 24381