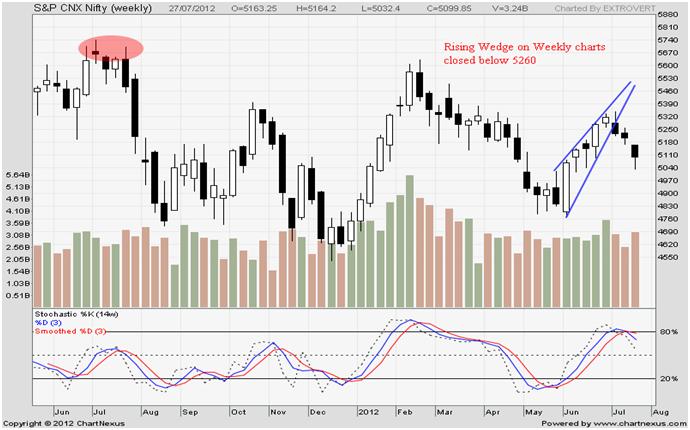

European shares ended Thursday’s volatile session sharply lower as European Central Bank President Mario Draghi disappointed investors who had been expecting some bold actions since his pledge last week to do ‘whatever it takes’ to defend the euro. Investors, who had pushed stocks higher before Draghi’s comments on hopes of some concrete policy support, rushed to dump equities, with the FTS Euro first 300 index closing 1.2 percent lower at 1,055.34 points, Spain’s IBEX slumping 5.2 percent and Italy’s FTSE MIB falling 4.6 percent, the biggest one-day decline in nearly four months.

European shares ended Thursday’s volatile session sharply lower as European Central Bank President Mario Draghi disappointed investors who had been expecting some bold actions since his pledge last week to do ‘whatever it takes’ to defend the euro. Investors, who had pushed stocks higher before Draghi’s comments on hopes of some concrete policy support, rushed to dump equities, with the FTS Euro first 300 index closing 1.2 percent lower at 1,055.34 points, Spain’s IBEX slumping 5.2 percent and Italy’s FTSE MIB falling 4.6 percent, the biggest one-day decline in nearly four months.

On the flip side, U.S. stocks on Thursday retreated for a fourth day after the European Central Bank failed to live up to its advance billing, offering only conditional moves in tackling Europe’s debt crisis. The slide in U.S. equities followed a global rout after ECB President Mario Draghi indicated the ECB plans to unite with governments in purchasing bonds in large enough quantities to curb the euro land’s debt trouble, although he conceded Germany’s Bundes bank was not fully on board with the concept. Among the individual stocks, Knight Capital Group Inc. shares nose-dived nearly 63 per cent to USD 2.58 a piece after pegging losses at USD 440 million from a trading glitch and saying it was looking at strategic options.

The three main indices closed in red in choppy trading session. The Dow Jones Industrial Average dipped 92.18 points, or 0.71 percent, to 12,878.88 at the close. The Nasdaq Composite Index fell 10.44 points, or 0.36 percent, to end at 2,909.77 and Standard & Poor’s 500 Index edged down 10.32 of a point, or 0.75 percent, to 1,365.00.

Crude oil ended the session 2.0 per cent lower at USD 87.20 per barrel. Natural gas closed into negative terrain with 7.9 per cent loss at USD 2.92 per MMBtu.

Following the crude’s footsteps, Gold closed the day’s trading with 1.0 per cent loss at USD 1590.50 per ounce. Silver also settled with a 1.9 per cent loss at USD 26.99 per ounce.

On Thursday, the FIIs continued to support Indian equity and debt market as a result they turned net buyer in both the markets.

Gross equity purchased stood at Rs. 2212.10 Crore and gross debt purchased stood at Rs. 787.00 Crore, while the gross equity sold stood at Rs. 1581.20 Crore and gross debt sold stood at Rs. 519.60 Crore.

Therefore, the net investment of equity and debt reported were Rs. 630.90 Crore and Rs. 267.40