Equity markets are witnessing excessive volatility in recent times due to a host of factors in domestic as well as global economies. While lower GDP growth, high fiscal and trade deficit, rising subsidy bill and depreciation of the rupee affect the domestic economy, global markets are facing the heat of the European debt crisis. These factors have taken a toll on the stock markets and diversified equity funds dropped more than 8% on an average over the last one year. Under these circumstances, one may explore a class of mutual funds where regular returns can be obtained by taking very little risk irrespective of the market conditions. Sounds strange? Welcome to the world of arbitrage funds.

Equity markets are witnessing excessive volatility in recent times due to a host of factors in domestic as well as global economies. While lower GDP growth, high fiscal and trade deficit, rising subsidy bill and depreciation of the rupee affect the domestic economy, global markets are facing the heat of the European debt crisis. These factors have taken a toll on the stock markets and diversified equity funds dropped more than 8% on an average over the last one year. Under these circumstances, one may explore a class of mutual funds where regular returns can be obtained by taking very little risk irrespective of the market conditions. Sounds strange? Welcome to the world of arbitrage funds.

How the concept works

Arbitrage funds aim to generate income by using arbitrage opportunities between the cash market and the futures (or derivatives) market. The arbitrage gain can be achieved by taking advantage of the mispricing that exists between the cash and the derivatives market. For example, let us assume that the stock of ABC Company is trading at Rs. 200. Let us also consider that the stock is traded in derivatives segment as well (all scrip’s are not traded in the derivative segment), where its future price is Rs. 210. In such a situation, an investor will be able to make a risk-free profit by selling a futures contract of ABC Company at Rs. 210 and buy an equivalent number of shares in the cash market at Rs. 200. When the settlement day will come, it wouldn’t matter which direction the stock price of the company has taken in the mean time because on the date of expiry (settlement date), the price of equity shares and their stock futures will tend to coincide. Now, the initial transaction has to be reversed, that is, buy back the contract in the futures market and sell off the equity. Thus four transactions have taken place: buying stocks, selling futures, selling stocks and finally buying futures. In this way, an investor earns the spread of Rs. 10 between the purchase price of the equity shares and the sale price of futures contract, irrespective of the share price.

Different arbitrage opportunities

The arbitrage opportunity mainly arrives when there is more volatility in the markets because heavy volatility leads to more mispricing in cash and futures market. Moreover, when a company merges with or taken over by another company, arbitrage opportunities may arise due to mispricing of the scrip. Also if the company announces buy-back of its own shares, there could be arbitrage opportunities due to difference in buy-back price and traded price. During declaration of dividend, the stock futures/options market can also provide an arbitrage opportunity as the stock price normally drops by the dividend amount when the stock goes ex-dividend. The mispricing across various indices can lead to arbitrage opportunities.

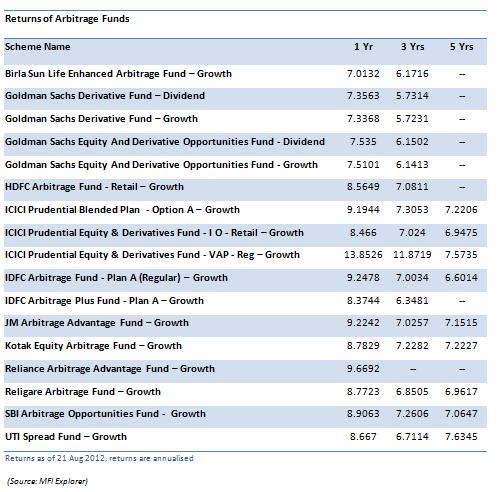

Over last 1-year, 3-year and 5-year time periods, the average returns generated by arbitrage funds were 8.73%, 6.9% and 7.15% respectively. The likes of ICICI Prudential Blended Plan – Option A , IDFC Arbitrage Fund – Plan A (Regular) , JM Arbitrage Advantage Fund , Kotak Equity Arbitrage Fund , Reliance Arbitrage Advantage Fund – Growth and SBI Arbitrage Opportunities Fund – Growth delivered more than 9% returns over the last one year.

Limitations

Arbitrage funds also have their limitations, which are particularly evident when there is stability in the market. Mispricing opportunities are relatively lower in stable market conditions and arbitrage funds normally lag in such situations. Also, cost issues are there in arbitrage funds. The brokerages and commissions involved in buying and selling futures and stocks, affect the returns of funds.

Tax perspective

Arbitrage funds are classified as equity or non-equity funds as per their average equity holdings. If the average equity component is more than 65%, it will be considered as an equity fund. Accordingly from tax perspective, the fund will get benefits of no dividend distribution tax, and no capital gains tax if sold after one year. But if this asset allocation level is not maintained, it will be treated as a non-equity fund and will be taxed like a debt fund.