The Bse Index Shuts at 18794 up 85 points from its Previous Close or +0.45%. The Nse Index Shuts at 5705 up 29 Points from its Previous Close or +0.50%.

The Bse Index Shuts at 18794 up 85 points from its Previous Close or +0.45%. The Nse Index Shuts at 5705 up 29 Points from its Previous Close or +0.50%.

- Daily Chart Indicates Nifty closed 5690 which suggest reversal signal. On daily chart Rsi & Cci given reversal buy signal while macd is at down side break out. Trend and momentum is bullish on end of day chart for Nifty.

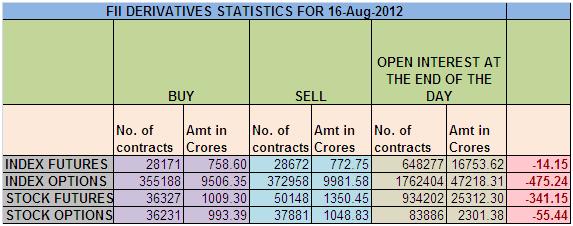

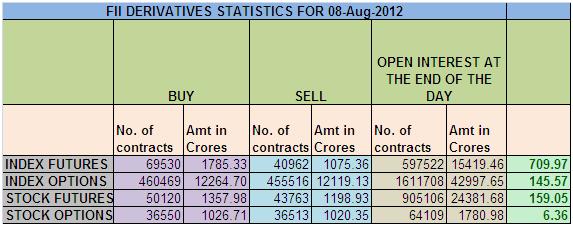

FII Derivative Data:

- FII bought 2375 Contracts of Index Future, worth -6.88 cores with net OI increasing by 8405 contracts. As FII were buyers but net amount came as negative which means FII sold in Opening and bought at the far end of session. Consider the following example Sell 9 unit at Rs 7 and Buy 10 Unit at 6 so net units comes as 1 and value comes to Rs-4.

- Nifty Future was up by 22 points and Open Interest in Index Futures increased by 8405, so FII have booked profits in shorts in Nifty and Bank Nifty Futures. Fresh longs have not been created as nifty is moving in sideways zone after big rally from 5200-5800.

- Nifty Spot closed at 5705 after making a high of 5729 and unable to move above the previous swing low of 5740 which shows it was a fake breakout above 5740. Gap filling of 5650-5683 has started and gap of 5650 did not got filled today, but should be filled in this week as per gap theory.

- Resistance for Nifty has come up to 5715 and 5730 which needs to be watched closely ,Support now exists at 5678 and 5650 .Trend is Sell on Rise till 5752 is not broken on closing basis.

- Nifty Future October Open Interest is at 2.62 cores with unwinding of 0.30 Lakh in OI, Shorts did profit booking in Nifty future.

- F&O turnover was at 1.12 lakh Cores with total contract traded at 2.17 lakh, PCR at 1.04 and VIX at 16.80, VIX is also trading at its lower end of range and a up move till 18.5-19 is on cards.

- 5800 CALL is having highest Open Interest of 73 lakhs with fresh addition of 3.1 lakhs in OI and Premium at 41.6000 CE Open Interest at 70 is second highest lakhs, and 6100 calls got unwounded today as premium moved from 8 to rs 2 .5400-6100 CE added 5.9 lakhs in Open Interest.

- 5600 PUT is having highest Open Interest of 64 lakhs with addition of 3.2 lakhs in OI and premium at 31.5, Bulls were just able to defend 5700 with addition of 2.9 lakhs. 5400-6100 PE added 8.3 lakhs in Open Interest.

- FII bought 613.98 cores and DII sold 430.60 cores in cash segment, INR closed at at 52.54.FII sold 87 cores in Stock Futures.

- Nifty Futures Trend Deciding level is 5698(For Intraday Traders), Trend Changer at 5748 NF(For Positional Traders). (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand). We have done 2 successful trades in past 2 days with trend changer level each 50 points..

- 5 DMA at 5729

- 20 DMA at 5619

- 50 DMA at 5424

- 200 DMA at 5209

- 5 Days Relative Strengthen Index at 52 and 14 Days Relative Strengthen Index at 63 Indicates Nifty placed in BULLISH Zone.

Nifty Spot Support & Resistance:

Nifty Resistance at It has the First resistance close to the level 5711 and above the level marks the track point at 5733 later zipper levels at 5755 marks.

Nifty Support at It has the First support close to the level 5688 and below the level marks the track point at 5666 later zipper levels at 5622 marks.

Nifty Future Momentum Call for 10 Oct’2012:

Buy Nifty Future above 5733 sl 5711 Tgt 5755-5777 {Or} Sell Below 5711 sl 5733 Tgt 5688-5666

Bank Nifty Future Momentum Call for 10 Oct’2012:

Buy Above 11535 sl 11488 Tgt 1575-11625 {Or} Sell Below 11444 sl 11488 Tgt 11355-11266

Nifty Future made a fresh September series high today at 5453. IIP data came at 0.1 which is as per market expectation. Another important Global event German Court gave in favor of using ESM and Germany Can Ratify ESM Fund with Conditions so nothing is stopping Bulls. Always remember hot money chase the momentum and in liquidity driven rally fundamental will take the back seat. So do not waste your time in finding top and bottom, Stay with trend and mint money.

Nifty Future made a fresh September series high today at 5453. IIP data came at 0.1 which is as per market expectation. Another important Global event German Court gave in favor of using ESM and Germany Can Ratify ESM Fund with Conditions so nothing is stopping Bulls. Always remember hot money chase the momentum and in liquidity driven rally fundamental will take the back seat. So do not waste your time in finding top and bottom, Stay with trend and mint money.