The US markets ended another session flat in lackluster trade as investors digested a string of mixed economic data and earnings reports. It was a day of extremely anemic volumes. The Dow traded within a 55 point range through the day as bluechips dragged. It was only the Nasdaq that managed to eke out a half percent gain.

The US markets ended another session flat in lackluster trade as investors digested a string of mixed economic data and earnings reports. It was a day of extremely anemic volumes. The Dow traded within a 55 point range through the day as bluechips dragged. It was only the Nasdaq that managed to eke out a half percent gain.- Dow Jones Industrial Average was down 0.06% or 7.36 points at 13164.78. Nasdaq Composite was up 0.46% or 13.95 points at 3030.93. Standard & Poor’s 500 was up 0.11% or 1.6 points at 1405.53.

- Also better economic data is now raising doubts that the Fed would launch any fresh bond buying programme next month. The CBOE volatility index slid below 15.

- On economic data front, consumer prices were flat for a second-straight month in July. Meanwhile US homebuilder sentiment rose in August to its highest level in more than five years. New York Fed Reserve empire state index of manufacturing activity fell unexpectedly into negative territory in August for the first time since last October.

- In key data to watch out for in the US today, weekly jobless claims are expected to rise marginally to 365,000. The Philadelphia Fed survey is expected to come in at minus 6.5, after a 12.5 decline last month. Also watch out for

- housing starts data.

- In the currency space, the dollar firm versus the euro after the US economic data boosted treasury yields and cut expectations of more monetary easing from the Federal Reserve.

- In commodities, crude prices gain with Brent above USD 116 levels, the highest level in more than three months following a sharp drawdown in US crude stockpiles.

- Indian ADRs ended mixed on Wednesday. In the IT space, Infosys was up 0.56% at USD 41.38, Wipro was up 0.5% at USD 8.05 and Patni was down 1.08% at USD 18.4.

- In the Telecom space, MTNL was up 0.5% at USD 1.206 and Tata Communication was up 0.12% at USD 8.33. In the Banking space, ICICI Bank was down 0.49% at USD 34.75 and HDFC Bank was down 0.65% at USD 35.01.

- In the other space, Sterlite was up 0.51% at USD 7.95, Dr Reddys was down 0.37% at USD 29.31 and Tata Motors was down 0.91% at USD 20.75.

F&O cues:

- Nifty options suggest mkt range of 5300-5500

- Total Puts add 5.7 lakh shares in Open Interest

- Total Calls add 1.5 lakh shares in Open Interest

- Highest OI buildup seen in 5000 Put & 5500 Call

- 5000 Put adds 1.3 lakh shares in Open Interest

- 5300 Put adds 10.2 lakh shares in Open Interest

- 5400 Put adds 5.8 lakh shares in Open Interest

- 5200 Put sheds 1.5 lakh shares in Open Interest

- 4900 Put sheds 13.5 lakh shares in Open Interest

- 5500 Call adds 4.1 lakh shares in Open Interest

- 5400 Call sheds 6.95 lakh shares in Open Interest

- 5300 Call sheds 4.2 lakh shares in Open Interest

- Total Nifty Futures added 8.3 lakh shares in OI.

- Stock Futures adds 50.6 cr shares in OI

- Nifty PCR rose to 1.21 from 1.2

- India VIX closed at 15.64 down by 2.31%

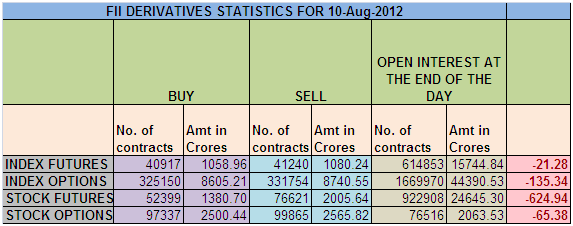

- FIIs in F&O on August 14

- FIIs net buy Rs 289 cr in Index Futures; Index Futures Open Int Contracts up by 7560

- FIIs net buy Rs 411 cr in Index Options; Index Options Open Int Contracts up by 46491

- FIIs net sell Rs 428 cr in Stock Futures; Stock Futures Open Int Contracts up by 7153

Market cues:

- FIIs net buy USD 65 million in cash market on August 13

- MFs net sell Rs 66 crore in cash market on August 13

- As per provisional data of August 14, FIIs were net buyers of Rs 258 cr in cash market. FIIs were net buyers of Rs

- 160 cr in F&O. DIIs were net buyers of Rs 76 cr in cash market.

FII sells 323 Contracts of Nifty, worth 21.28 cores with net OI increasing by 7909 contracts.

FII sells 323 Contracts of Nifty, worth 21.28 cores with net OI increasing by 7909 contracts.- As Nifty Future was down by 5 points and OI has increased by 7909, FII have started shorting the index futures in small quantity. As FII average traded price comes at a weird number of 13179 which shows they are trading in fewer volumes and mostly doing day trading.

- Nifty Spot closed at 5320 after making a high of 5330 and low of 5294 ,nifty has closed above 5300 but it has formed lower high and lower lows .As discussed earlier the range of 5350-80 is supply zone, cannot be broken in single attempt. Bulls are trying from past 2 days to close Nifty above 5350 but are failing each time suggesting weakness in price and eventual dip till 5260 can come in next 2 days.

- Resistance for Nifty has come up to 5350 and after that 5380 which needs to be watched closely ,Support now exists at 5286 ,Below 5260 gap filling will start till 5216 .Trend is still buy on Dips till 5213 is not broken on closing basis.

- Nifty August OI is at 2.43 cores with an addition of 3.7 Lakh in OI, shorts were added by Retailers and HNI.

- Total Future and Options turnover was 0.93 lakh Cores with total contract traded at 1.8 lakh.

- 5400 CE saw an unwinding of 2.5 lakhs and total OI stands at 75 lakhs making immediate ceiling for market, 5500 CE still having highest OI of 85 lakhs, 5300 CE also saw an addition of 1.1 lakhs with total OI now standing at 41 lakhs, 4900-5500 CE saw an unwinding of 2 lakhs in OI suggesting weak bears have unwounded the position as Nifty is unable to close below 5300.

- Lying on Put side 5000 PE saw an addition of 1 lakhs, immediate support of Nifty as total OI at 1.05 core.4900-5500 PE added total of 10 lakhs in OI. 5200 PE added 6 lakhs in OI suggesting market participants are not showing nifty closing below 5200 for coming week.

- FII bought 83 cores and DII sold 536 cores in cash segment.INR closed at 55.41 Live INR rate @ FII has sold 634 in stock futures namely in SBI and PSU banks.

- Nifty Futures Trend deciding level is 5265, Trend Changer at 5266 Nifty Above this Level Bulls will rule Nifty Below this levels Bears have superior hand.