The Bse Index Closes on Tuesday at 17602 up 189 Points or +1.08% and the Nifty fasten store at 5337, up 54 points from the previous close or +1.03%. The CNX Midcap index was up 0.1% while the BSE Small cap index gains 0.4% in Yesterdays Trade. The market breadth was positive with advances at 785 against declines of 642 on the NSE.

The Bse Index Closes on Tuesday at 17602 up 189 Points or +1.08% and the Nifty fasten store at 5337, up 54 points from the previous close or +1.03%. The CNX Midcap index was up 0.1% while the BSE Small cap index gains 0.4% in Yesterdays Trade. The market breadth was positive with advances at 785 against declines of 642 on the NSE.

The markets gained notably on the second consecutive day with auto, IT, banking and realty leading the rally. Capital goods, FMCG and power, too, gained significantly while healthcare and oil & gas closed negative.

Nifty Top Gainers in Yesterday’s Trade: Tata Motors, Idfc, Dlf and Ambuja Cement

Nifty Top Losers in Yesterday’s Trade: Cairn India, Hero Moto Corp, Power Grid and Bpcl.

Stock Cipher:

- DLF Q1FY13 Consolidated YoY Net Profit at Rs.293 cr Vs Rs.212 cr; Income from ops Rs.2,197.7 cr Vs Rs.2,617 cr .

- Religare Enterprises Q1FY13 Consolidated QoQ Net Profit at Rs.24.2 cr vs Rs.86.2 cr; Income from ops at Rs.825.2 cr vs Rs.843 cr.

- Aurobindo Pharma and Glenmark has got US FDA approval for generic Asthama drug.

- Dhanlaxmi Bank Q1 net loss at Rs 11.8 cr vs profit of Rs 3.4 cr (YoY); NII at Rs 75 cr vs Rs 63 cr (YoY).

- IDBI Bank has received 3.13 cr shares of 3i Infotech as a part of the restructuring process at Rs. 19.74/share.

- BEML Q1FY13 YoY Net loss at Rs.39.44 cr vs net profit of Rs.15.87 Cr; Net sales at Rs.413.91 cr vs Rs.553.91 Cr.

- Escorts Q3 YoY Net Profit at Rs.27 cr Vs Rs.13.2 cr; Net sales at Rs.859 cr Vs Rs.729 cr.

- Seamec has got USD 18 million contract from Leighton Welspun Contractors.

- The finance minister yesterday made comments on high interest rates scenario. This sparks hope for traders that the government will put pressure on the RBI to ease monetary policy. Auto, banks and realty stocks were on buyers in yesterday’s radar.

- NHPC Q1 net profit at Rs 670 cr vs Rs 791 cr (YoY); total income from operations at Rs 1422 cr vs Rs 1470 cr (YoY).

- J&K Bank Q1 Net Profit at Rs 246 cr Vs Rs 182 cr (YoY); NII at Rs 536 cr Vs Rs 437 cr (YoY).

- Jet Airways is planning to spin off Jet Privilege Services into separate company in 45 days. The Jet Privilege is Jet Airways Global frequent flyer service.

- Tata Chemicals Q1 Q1 Net Profit at Rs 107.6 cr Vs Rs 200 cr (YoY); Q1 Net Sales at Rs 3,021 cr Vs Rs 2,974.5 cr (YoY).

- Balrampur Chini Q1 net loss at Rs 18 cr vs loss of Rs 19.4 cr (YoY); net sales at Rs 692 cr vs Rs 567 cr (YoY).

- Aurobindo Pharma Q1 cons net loss at Rs 129 cr Vs loss of Rs 123 cr (YoY); cons net sales at Rs 1,197 cr Vs Rs 1,065 cr (YoY).

Bulls managed to see close Nifty above 5333. The subsequently object are 5422 and 5511. 5333-5377 has a Resistance area. So some time and consolidation needed to Jump the level and Vice-Versa Down side Support at 5288-5244 levels if closes below 5155 can bring Blood Bath.

Last Close at 5336 up 54 points, Last High at 5350 Low at 5281, Weekly High at 5350 and low at 5032 and 5 DMA at 5261, 20 DMA at 5203, 50 DMA at 5152 and 200 DMA at 5108.

5-Days Relative Strength Index at 80 and 14-Days Relative Strength Index at 63. It Indicates Nifty Placed in BULLISH precinct.

NIFTY: RESISTANCE @ It has the First resistance close to the level 5355 and above the level marks the track point at 5377 later zooper levels at 5400 marks.

SUPPORT@ It has the first support close to the level of 5311 and below this level mark next support is seen at 5288 later dipping levels near 5244 marks.

NIFTY FUT MOMENTUM CALLS FOR 08 Aug’2012:

Buy Nifty August Future above 5355 Sl 5311 Tgt 5377-5399 {Or} Sell Nifty August Future below 5288 Sl 5311 Tgt 5266-5244.

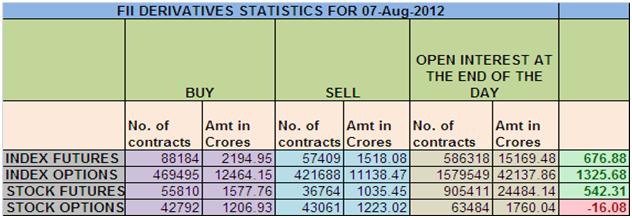

FII DERIVATES DATA ANYALASIS

- FII bought 30775 contracts of Nifty worth Rs. 676.88 Crores with Net Open Interest increasing by 36599 contracts.

- As Nifty Futures up by 51 Points and OI has increased by 36599 contracts means FII have added longs in Index Future, as Nifty has closed above the rollover range of 5210.

- Nifty today has formed double top pattern which is bearish and it gets confirmed if it is unable to take the 5350 eod tomorrow. One more String to observe Breadth of stocks rising which is quite less and, Nifty is just moving by supporting of Banks & Rill, till we do not have midcaps also performing we can see Nifty coming down and fill gaps till 5200.

- FII bought 815 Crores and DII bought 55 Crores in cash segment. INR closes at 55.25.