As per overseas market view, the US markets eke out marginal gains following the Fed’s beige book report, but trading was thin and muted throughout most of the session as investors remained cautious ahead of Chairman Bernanke’s speech tomorrow. The CBOE volatility index rose more than 3% to above 17.

As per overseas market view, the US markets eke out marginal gains following the Fed’s beige book report, but trading was thin and muted throughout most of the session as investors remained cautious ahead of Chairman Bernanke’s speech tomorrow. The CBOE volatility index rose more than 3% to above 17.- Dow Jones Industrial Average was up 0.03% or 4.49 points at 13107.48. Nasdaq Composite was up 0.13% or 4.05 points at 3081.19. Standard & Poor’s 500 was up 0.08% or 1.19 points at 1410.49 in New York stock exchange

- On economic data front, the US economy fared slightly better than expected in the second quarter, expanding at a 1.7-percent annual rate. Pending home sales in July jumped to their highest level in more than two years.

- According to the Fed’s latest beige book, the economy continues to show improvement in July and early August, but manufacturing activity has weakened in many areas of the country. The Fed also says that retail activity, including auto sales, has picked up since its previous report.

- In key data to watch out for in the US today, weekly jobless claims are expected to dip slightly to 370,000.

- In the currency space, the euro stays near the 7-week high versus the dollar. The dollar index towards the 81.50 mark.

- In commodities, Nymex crude prices decline following a rise in US crude stockpiles. Brent crude stays above USD 112 levels.

- From the precious metals space, gold price trade around USD 1655 levels.

- Indian ADRs ended mixed on Wednesday. In the IT space, Wipro was up 0.25% at USD 8.03, Patni was unchanged at USD 18.66 and Infosys was down 0.77% at USD 42.75.

- In the Banking space, HDFC Bank was up 0.62% at USD 34.11 and ICICI Bank was down 0.33% at USD 33.14. In the Telecom space, Tata Communication was up 0.37% at USD 8.15 and MTNL was down 1.95% at USD 1.51.

- In the other space, Sterlite was down 5.47% at USD 7.26, Dr Reddys was down 0.59% at USD 30.3 and Tata Motors was up 0.62% at USD 21.1.

F&O CUES:

- Nifty options suggest market range of 5200-5400

- Total Puts shed 37.6 lakh shares in Open Interest

- Total Calls adds 33.4 lakh shares in Open Interest

- 5400 Call adds 15.25 lakh shares in Open Interest

- 5300 Put sheds 19.2 lakh shares in Open Interest

- Sept 5400 Call adds 6.7 lakh shares in Open Interest

- Sept 5300 Call adds 3.9 lakh shares in Open Interest

- Sept 5200 Put adds 3.5 lakh shares in Open Interest

- Sept 5100 Put adds 2.8 lakh shares in Open Interest

- Total Nifty Futures shed 3.1 lakh shares in OI

- Stock Futures sheds 58.4 lakh shares in OI

- Nifty PCR fell to 1.13 from 1.23

- India VIX closed at 16.74 up by 2.39%

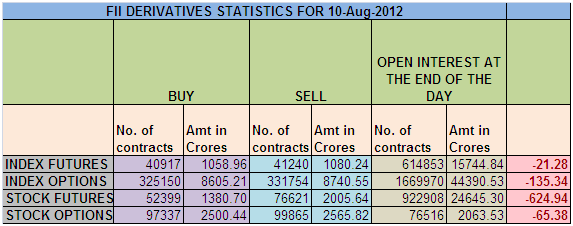

- FIIs in F&O on August 29

- FIIs net sell Rs 7 cr in Index Futures; Index Futures Open Int Contracts down by 19355

- FIIs net sell Rs 772 cr in Index Options; Index Options Open Int Contracts up by 12916

- FIIs net sell Rs 579 cr in Stock Futures; Stock Futures Open Int Contracts up by 5755