The Bse Index Closes on Thursday at 17657 down 71 Points or -0.40% and the Nifty fasten store at 5363, down 17 points from the previous close or -0.32%. The CNX Midcap index was down 0.2% while the BSE Small cap index gains 0.3% in Yesterdays Trade. The market breadth was negative with advances at 645against declines of 798 on the NSE.

The Bse Index Closes on Thursday at 17657 down 71 Points or -0.40% and the Nifty fasten store at 5363, down 17 points from the previous close or -0.32%. The CNX Midcap index was down 0.2% while the BSE Small cap index gains 0.3% in Yesterdays Trade. The market breadth was negative with advances at 645against declines of 798 on the NSE.

The markets trade in a tapered range in yesterday and closed with temperate declines. FMCG, metal, consumer durables and banking were the biggest laggards in yesterday’s session while capital goods, oil & gas and auto gained drastically.

Nse India Top Gainers in Yesterday’s Trade: Idfc, Hero Moto corp, Ranbaxy and M&M

Nse India Top Losers in Yesterday’s Trade: Itc, Ster, Hindalco and Sesa Goa.

Stock Cipher:

- Kingfisher Airlines has started paying the overdue salary to some employees. The March salary payment to ground staff and cabin crew has begun.

- Orchid Chemicals Q1FY13 YoY net loss at Rs.51 cr vs profit of Rs.15.5 cr; net sales at Rs.315.6 cr vs Rs.373.8 cr.

- Alok Industries is planning to shut 45 out of the 137 exclusive retail outlets next month.

- Jain Irrigation Q1FY13 (YoY) net loss at Rs.16.8 cr vs profit of Rs.82.4 cr; net sales at Rs.848.6 cr vs Rs.931.3 cr.

- Reliance Industries has proposed to drill exploration well in KG’ D6 block at own cost..

- GVK Power has dropped the plan to develop SEZ in Tamil Nadu. The company has deferred work on seaport venture in Gujarat.

- Oriental Bank of Commerce has cut the base rate by 10 bps to 10.40%.

- Jet fuel prices have been hiked by over 3.2%.

- Infosys visa case trial has been pushed to September 17 as judge seeks more time. The trial was to come up on August 20.

- Wockhardt will be launching generic version of clot-buster drug Plavix in US.

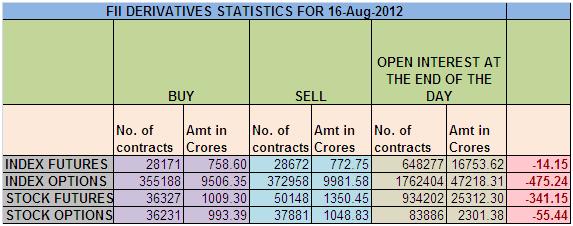

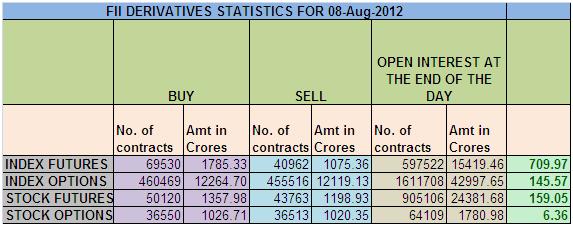

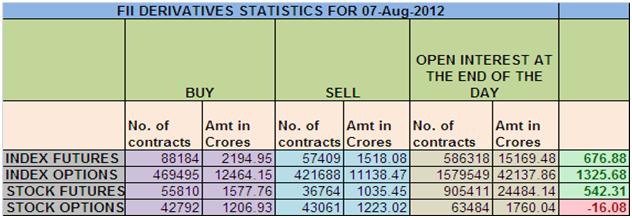

FII DERIVATIVES DATA

- FII sold 501 Contracts of Nifty, worth 14 cores with net OI increasing by 3799 contracts.

- As Nifty Future was down by 25 points and OI has increased by 3799, FII have booked profits in longs in Index futures. Also be aware that today closing on NF is first double digits losses in August series.

- Nifty Spot closed at 5363 after making a high of 5390,as said in Weekly analysis 5386 will be an important level as its 100 WSMA .As discussed earlier the range of 5350-80 is supply zone, cannot be broken in single attempt.

- Resistance for Nifty has come up to 5390 and 5400 (as its swing high in Oct 2011) which needs to be watched closely ,Support now exists at 5340 and 5319 .Trend is still buy on Dips till 5238 is not broken on closing basis. We have weekly closing tomorrow and close above 5319 will keep weekly in uptrend

- Nifty August OI is at 2.58 cores with an unwinding of 1.19 Lakh in OI, longs were liquidated by Retailers and HNI.As OI figure saw an unwinding of 1.19 lakhs i expect some good move tomorrow. We have a long weekend ahead as Monday is a Holiday on eve of EID.

- Total F&O turnover was 0.86 lakh Cores with total contract traded at 1.58 lakh lowest in 2012. These were increase of 10% in cash market volumes which indicates distribution by smart money on higher levels.

- 5300 CE also saw an addition of 1.11 lakhs with total OI now standing at 38 lakhs (Smart bears writing calls) ,5400 CE saw an addition of 3.3 lakhs and total OI stands at 65 lakhs making immediate ceiling for market, 5500 CE still having highest OI of 92 lakhs, , 5000-5600 CE saw an addition of 10 lakhs in OI suggesting bears have have started getting warmed up.

- On Put side 5000 PE saw an addition of 0.7 lakhs, strong support of Nifty as total OI at 1.02 core.5000-5500 PE unwounded total of 0.90 lakhs in OI.5300 PE added 0.36 lakh in OI and having the OI at 86 lakhs which suggests traders are getting confident that 5300 will not break in near term and immediate support in any pullback.

- FII bought 95 cores and DII bought 225 cores in cash segment.INR closed at 55.71. FII has sold 341 cores in stock futures.

- Nifty Futures Trend Deciding level is 5390, Trend Changer at 5290 NIFTY (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand).

- 5 DMA at 5347

- 20 DMA at 5238

- 50 DMA at 5205

- 200 DMA at 5115

- 5-Days Relative Strength Index at 71

- 14-Days Relative Strength Index at 64. It Indicates Nifty Placed in BULLISH precinct.

NIFTY: RESISTANCE @ It has the First resistance close to the level 5377 and above the level marks the track point at 5400 later zooper levels at 5444 marks.

SUPPORT@ It has the first support close to the level of 5355 and below this level mark next support is seen at 5333 later dipping levels near 5311 marks.

NIFTY FUT MOMENTUM CALLS FOR 17 Aug’2012:

Buy Nifty August Future above 5400 Sl 5377 Tgt 5422-5444 {Or} Sell Nifty August Future below 5355 Sl 5377 Tgt 5333-5311.