The week begins on a cynical note as financial uncertainties in Euro zone continued to preoccupy the investors. We had mentioned a key support of 5159 level in our previous report. As expected, a breach of this level had triggered immense selling pressure and indices plunged drastically on Thursday’s session to test the mentioned support level of 5041. On Friday’s session, surprisingly, indices opened significantly higher on the back of strong closing from European and US markets after the ECB president, Mario Draghi, said that the European Central Bank would do “Whatever it Takes” to ensure the survival of the Euro. However, indices pared most of their early gains during the second half the session on Friday to close at the 5100 mark. We witnessed strong selling pressure in the Midcap and Small Cap counters during the last two trading sessions of the week. On the sectoral front, Capital Goods, Banking, Metal and realty sectors counters plunged during the week; whereas FMCG was the only sector to close in the positive territory. The Sensex closed with a loss of 1.86%; whereas Nifty lost 2.02% vis-à-vis the previous week.

The week begins on a cynical note as financial uncertainties in Euro zone continued to preoccupy the investors. We had mentioned a key support of 5159 level in our previous report. As expected, a breach of this level had triggered immense selling pressure and indices plunged drastically on Thursday’s session to test the mentioned support level of 5041. On Friday’s session, surprisingly, indices opened significantly higher on the back of strong closing from European and US markets after the ECB president, Mario Draghi, said that the European Central Bank would do “Whatever it Takes” to ensure the survival of the Euro. However, indices pared most of their early gains during the second half the session on Friday to close at the 5100 mark. We witnessed strong selling pressure in the Midcap and Small Cap counters during the last two trading sessions of the week. On the sectoral front, Capital Goods, Banking, Metal and realty sectors counters plunged during the week; whereas FMCG was the only sector to close in the positive territory. The Sensex closed with a loss of 1.86%; whereas Nifty lost 2.02% vis-à-vis the previous week.- Despite strong global cues, our benchmark indices faced immense selling pressure near day’s high on Friday’s session. The selling pressure was mainly seen in PSU Banks and other midcap counters. Indices are now hovering around the strong support zone of ‘200-day SMA’ and 50% Fibonacci retracement level, which is around 5100 – 5032, respectively. We are also observing a positive crossover in the daily ‘Stochastic’ oscillator. Hence, the possibility of a bounce back from current levels cannot be ruled out. The immediate resistance for the market is seen at 5150 level. If indices manage to sustain above this level, then the indices may rally further towards 5257 – 5300 levels. On the downside, last week’s low of 5032 would act as a strong support level for the markets. A breach of this level would augment pessimism and indices are likely to test 4991 – 4950 levels The coming week is likely to be volatile on account of RBI Monetary policy announcement on Tuesday’s session. Hence, we advise traders to stay light on the positions and avoid taking undue risks prior to the policy announcement.

Nifty Fibo Fans:

As we discussed previous Fibonacci fans are a magnificent tools to find Swing Top and Swing Bottom of Nifty. As Shown above 5043 seems to be swing bottom as Fibo charts.

Nifty Fibo Retracement:

Nifty Fibonacci Retracements from 4770-5350 are drawn above chart. Closer look at the same gives that Nifty has been consolidating in the range of 50% retracement at 5060 and 61.8% retracement at 5127.

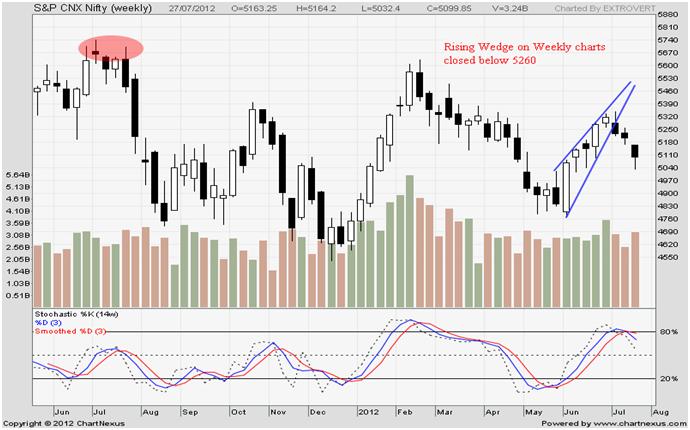

Nifty Weekly Chart:

Contracting Triangle with resistance at 21 Week ema at 5152 and trading between a parallel channel with HAMMER Candle Stick Formation which is a reversal pattern, close above 5152 will give more weight age to this pattern.

Rising Wedge pattern on Weekly Charts, which became active with breakdown below 5285 and eventually touching 5043 as we saw the following up action once 5169 got broken.