The Bse Index Shuts at 18805 up 174 points from its Previous Close or +0.93%. The Nse Index Shuts at 5709 up 56 Points from its Previous Close or +0.99%.

The Bse Index Shuts at 18805 up 174 points from its Previous Close or +0.93%. The Nse Index Shuts at 5709 up 56 Points from its Previous Close or +0.99%.

Infy Results before Market Opening & Hdfc after Market Hours & IIP data at 11.00 A.M

- Seeing as tomorrow is a significant day with the start of the Results Season getting kicked off by the bell weather Infy it is likely to garner a lot of interest and significance since this result is likely to define the performance of the Corporate Sector for the Q2 of 12-13 which has largely been bearish when compared with the last year due to the higher interest costs and slackening Economic Growth.

- The charts are indicating that the Markets are likely to remain volatile during the current Results seasons with the Indices facing severe resistance at the higher side which is 5730-5770 and it attains significance since these mentioned levels have not been breached during the last few sessions and the Indices dropped on account of profit booking to the 5650-5500 levels as well.

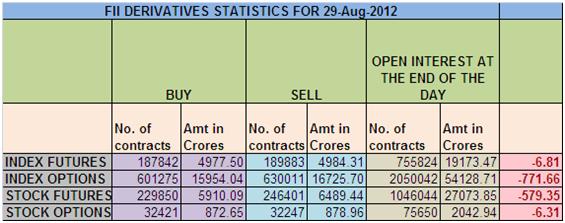

FII Derivative Data:

- FII sold 1727 Contracts of Index Future, worth 125.81 cores with net OI increasing by 39437 contracts.

- Nifty Future was up up by 66 points and Open Interest in Index Futures increased by 39437,so FII have created fresh longs in Nifty and Bank Nifty Futures.

- Nifty Spot closed at 5708 after making a low of 5637 and not breaking our Sell area of 5632 as given yesterday we got a 66 points rally today. Nifty daily chart is forming a Head and Shoulder pattern we are in process of forming a Right Shoulder now so if 5815 is not breached and 5630 gets broken in coming week lower levels are quiet possible.

- Resistance for Nifty has come up to 5728 and 5752 which needs to be watched closely ,Support now exists at 5688 and 56661 .Trend is Buy on Dips till 5688 is not broken on closing basis.

- Nifty Future October Open Interest is at 2.53 cores with unwinding of 2.3 Lakh in OI,shorts did profit booking in Nifty future .

- Future & Option turnover was at 1.38 lakh Cores with total contract traded at 2.50 lakh, PCR at 0.96 and VIX at 16.49.Volumes have been on decline from past 3 days which is a silver lining for bulls as traders are not unwinding positions and dips can be used to make a base for sustainable rally. Discussion became reality today

- 5800 Call is having highest Open Interest of 83 lakhs with fresh addition of 6.2 lakhs in OI and Premium at 42.5900 CE Open Interest at 83 with net addition of 5.74 lakhs in OI so speculative or smart money is buying 5900 Call at premium of rs 16, and 5700 Call also unwounded 5.2 lakh in OI as bulls captured 5700 again .5400-6100 CE unwounded 2.2 lakhs in Open Interest.

- 5600 Put is having highest Open Interest of 70 lakhs with addition of 6.39 lakhs in OI and premium at 23,5700 PE showed added of 3.7 lakhs .5400-6100 Put unwounded 2.4 lakhs in Open Interest. So it seems rally is on back of short covering only.

- FII bought 1043.41 cores and DII sold 573.72 cores in cash segment, INR closed at at 52.75. FII sold 311 cores in Stock Futures.

- Nifty Futures Trend Deciding level is 5695 (For Intraday Traders), Trend Changer at 5738 (For Positional Traders)

- 5 DMA at 5698

- 20 DMA at 5649

- 50 DMA at 5448

- 200 DMA at 5218

- 5 Days Relative Strengthen Index at 54 and 14 Days Relative Strengthen Index at 61 Indicates Nifty placed in BULLISH Zone.

Nifty Spot Support & Resistance:

Nifty Resistance at It has the First resistance close to the level 5711 and above the level marks the track point at 5755 later zipper levels at 5777 marks.

Nifty Support at It has the First support close to the level 5688 and below the level marks the track point at 5666 later zipper levels at 5644 marks.

Nifty Future Momentum Call for 12 Oct’2012:

Buy above 5755 sl 5733 Tgt 5775-5800 {Or} Sell Below 5711 sl 5733 Tgt 5688-5666

Bank Nifty Future Momentum Call for 12 Oct’2012:

Buy Above 11600 sl 11555 Tgt 11640-11690 {Or} Sell Nifty Future Below 11510 sl 11555 Tgt 11470-11420

The Bse Index Shuts at 18632 down 163 points from its Previous Close or -0.86%. The Nse Index Shuts at 5653 down 53 Points from its Previous Close or -0.92%.

The Bse Index Shuts at 18632 down 163 points from its Previous Close or -0.86%. The Nse Index Shuts at 5653 down 53 Points from its Previous Close or -0.92%.

The Bse Index Shuts at 18,350 down – 147 Points from its Previous Close or -0.79%. The Nse Index Shuts at 5555 down by -46 Points from its Previous Close or -0.82%.

The Bse Index Shuts at 18,350 down – 147 Points from its Previous Close or -0.79%. The Nse Index Shuts at 5555 down by -46 Points from its Previous Close or -0.82%. The Bse Index put up the lid at 17384 down 45 points or -0.26% and Nifty Shut Stop at 5254, down 5 points or -0.09% from the previous close. CNX Midcap index was up 0.1% and BSE Small cap index was gained 0.2% in Yesterday’s Trade. The market breadth was positive with advances at 780 against declines of 635 on the NSE.

The Bse Index put up the lid at 17384 down 45 points or -0.26% and Nifty Shut Stop at 5254, down 5 points or -0.09% from the previous close. CNX Midcap index was up 0.1% and BSE Small cap index was gained 0.2% in Yesterday’s Trade. The market breadth was positive with advances at 780 against declines of 635 on the NSE.