As per market outlook, the BSE Index put up the lid at 17542 up 51 points or +0.29% and Nifty Shut Stop at 5315 up 27 points or +0.52% from the previous close. CNX Midcap index was up 0.4% and BSE Small cap index was gained 0.3% in Yesterday’s Trade. The market breadth was positive with advances at 716 against declines of 706 on the NSE.

As per market outlook, the BSE Index put up the lid at 17542 up 51 points or +0.29% and Nifty Shut Stop at 5315 up 27 points or +0.52% from the previous close. CNX Midcap index was up 0.4% and BSE Small cap index was gained 0.3% in Yesterday’s Trade. The market breadth was positive with advances at 716 against declines of 706 on the NSE.

The market traded volatile in yesterday’s ttrade and closed with moderate gains.

Top Nse India Gainers were: Dlf, Idfc, Hindalco and Jp Assosiate.

Top Nse India Lossers Were: Tata Steel, Gail, Jindal Steel and Bpcl.

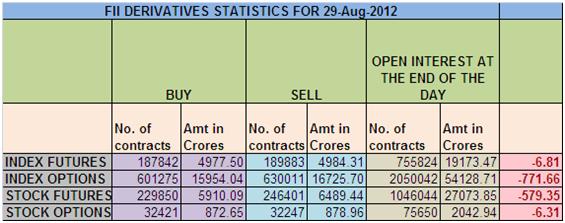

FII Derivative Data:

- FII sold 2041 Contracts of Index Future, worth 6 cores with net OI decreasing by 19355 contracts.

- Since Nifty Future was down by 50 points and OI has decreased by 19355, FII have booked profit in longs, as the total OI is down by 19K and sell figure is just 6 cores meaning they sold longs and have shorted partially.

- Nifty Spot closed at 5288 after making the low of 5283, Bulls were under pressure from morning as they 5325 got broken on Nifty. Ahead of expiry breaking of 5300 is a danger for bulls as expiry pressure can bring a swift fall and gap filling till 5216 can take place.

- Resistance for Nifty has come up to 5309 and 5329 which needs to be watched closely ,Support now exists at 5266 and 5243 .Trend is Sell on Rise till 5329 is not broken on closing basis.

- Nifty August OI is at 1.6 cores with an unwinding of 41 Lakh in OI, but the same got roll overed to September Series. September Series OI is at 1.53 lakhs so 36 lakhs got roll overed Longs are getting roll overed to next series.

- Whole F&O turnover was 1.70 lakh Cores with total contract traded at 2.53 lakh, Breadth was terrible and stocks were falling like nine pins.

- 5300 CE also saw an addition of 14.6 lakhs with total OI now standing at 49 lakhs. 5300 CE has premium of Rs 15 and Call writers have added 14.6 lakhs OI, so 5300 will be immediate resistance for market tomorrow.

- 5300 PE sheded 19 lakh in OI and having the OI at 76 lakhs put writers ran for cover as Nifty broke and closed below 5300.5200 PE is next support at per Option table as we have gap from 5266-5219 so do not be surprised if we see 5219 tomorrow. As of now 5200 is strong base from market. FII have sold 771 cores in Options suggesting selling in Put options they were holding as hedge, Are we near reversal?

- FII bought 143 cores and DII sold239 cores in cash segment. INR closed at 55.67. FII were again sellers of 579 cores in Stock futures.

- Nifty Futures Trend Deciding level is @ 5299, Trend Changer is @ 5327, Nifty were consolidating near 5327-5332 range before falling and we got early indication of fall as we traded 2 hours below 5327. For tomorrow this level will be tough resistance to crack. (Beyond this Level Bulls will rule Nifty/Beneath this levels Bears have upper hand).

- 5 DMA at 5335

- 20 DMA at 5333

- 50 DMA at 5256

- 200 DMA at 5120

- 5 Days Relative Strengthen Index at 38 and 14 Days Relative Strengthen Index at 41. Indicates Nifty placed in BEARISH Zone.

Nifty Support & Resistance:

Nifty Resistance at It has the First resistance close to the level 5333 and above the level marks the track point at 5355 later zipper levels at 5400 marks.

Support at It has the first support close to the level of 5288 and below this level mark next support is seen at 5266 later dipping levels near 5244 marks.

Nifty Future Momentum Call for 30 Aug’2012:

Nifty Future Buy above 5333 sl 5311 Tgt 5355-5400 {Or} Nifty Future Sell Below 5288 sl 5311 Tgt 5266-5244.