An interesting fact to note is that the gold and the US dollar relation has been brutally spoiled for the whole of September, till date. Since the beginning of September, gold prices have fallen over 8 % while the dollar index has also declined more than 3%. Surprisingly, gold has no relation with the euro anymore and, the latter has appreciated over 2%.This denotes the overall bearish trend of gold, for the first time in last 13 years in 2013 is still unbroken. Moreover, globally, gold investors are a bit cautious, seeing a lot of economic developments from the US and the euro-zone. We have seen gold investors closely watching for the US’ decision on its bond-buying programme, which was in any case sorted in mid-September however; a new report has come up now, linking to the US debt ceiling fiasco. Therefore, since the beginning of October, we have been seeing gold being very quiet and, the daily volatility has also come down. In fact, the trade participations have fallen sharply. The gold derivatives contracts that are mostly traded at the COMEX, a division of the NYMEX, shows the volumes have been massively lower in the recent past and, the aggregate open interests are at a multi-year low. This also indicates that unless there is precision in the market, gold should continue to remain in distress. Hence, we may continue to hold a bearish stance on the gold price trend. Therefore, we emphasize on the likely economic data and the developments in the next week expected globally.

Primarily, the investment demand on gold that was steady over the last few months has now started to decline. As per the SPDR gold trust, the world’s largest gold backed ETF, gold holdings have declined from 905 tons to 899 tons though it is a meager number but, the sentiment is driving gold prices lower. Another important factor that is looming in the market is the US debt ceiling. Though there is still no clarity on the debt ceiling, the US House of Representatives Speaker John Boehner stated that the House would not vote on a spending bill without conditions to end the government shutdown, in addition to demanded spending cuts in exchange for raising the government’s debt ceiling. This comment suggests the government shutdown would continue for a 2nd week, or awaiting politicians reach a deal on the US debt issue. This event should be supportive for gold bullion to trade higher however; such a scenario is still not visible in gold yet as, on the other side, gold demand is diminishing and the participation and activities are lowering. Therefore, we believe that the gold price trend may continue to be in doldrums and may remain steady to slightly bearish. Coming to the economic data analysis we believe that the ruined relationship between gold and the euro may continue in the near -term and likely that the former may stay down while the latter should continue to appreciate. So, we analyze the European economic data and, the events may have a lesser effect on gold. Likewise, the data that were expected last week from the US have been put off to next week, while there is still no clarity on the dates of the economic releases. However, we believe that if the September non-farm payroll data releases next week may show decline as the ADP private payrolls data showed a huge decline in the data. In this regard, gold may advance for a while in the next week. The other conventional data releasing from the US in the next week are likely to be mixed for the economy (detailed explained in our economic analysis report), which may help gold to again turn lower. Finally, from Asia, we have a few conventional data that are likely to provide a moderate impact on the gold market. However, the rupee, which appreciated in the last week, is likely to continue its gaining streak and by which gold prices at the local market may also come down further. Therefore, we hold a bearish view on gold for the next week while the market is expected to remain cautious due to global events which may show further unforeseen developments.

SILVER REVIEW AND OUTLOOK

In the last week silver prices traded steady and ended the week at $21.70 at the local market December futures settled the week at Rs. 48,197 down by more than Rs. 500 due to Indian rupee appreciation. Also, the silver commodity traded down along with the bearish view noticed on gold commodity. In the next week we believe silver prices locally should trade down owing to further rupee appreciation. While, at the global market silver prices though may trade steady while weakness should be continued. However, if any strong decisions taken from US government on debt ceiling then possibly silver could turn volatile. At the investment front there has not been much development on silver commodity. Moreover, the persisting weakness in base metals and weak equity markets across the globe should have further pressure on silver prices. Therefore, we are suggesting silver prices to continue its bearish tone in the next week. From the domestic market front, sustained selling by stockiest, driven by sluggish demand due to ongoing ‘Sharadhs’, an inauspicious fortnight in Hindu mythology for making fresh purchases amid a weak global trend, mainly kept pressure on gold and silver. Also, in a similar fashion, silver ready fell further by Rs 280 to Rs 49,300 per kg and weekly-based delivery by Rs 430 to Rs 49,150 per kg. Silver coins also tumbled by Rs 1,000 to Rs 84,000 for buying and Rs 85,000 for selling of 100 pieces. The detailed economic data analysis is available in our weekly economic report. Overall, we believe silver prices to trade down in the next week.

For More Details on Commodity Weekly Outlook Visit www.profitkrishna.com

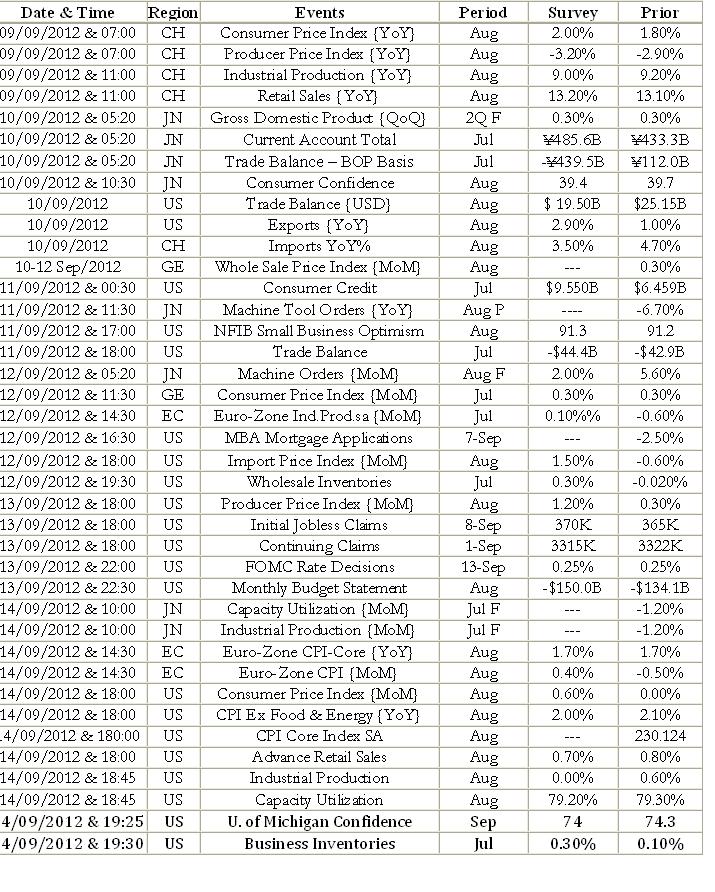

Advance tax data for Q2 September 2012, policy meeting of the Federal Open Market Committee on US interest rates and mid-quarter policy review by the Reserve Bank of India (RBI) will dictate near term trend on the bourses.

Advance tax data for Q2 September 2012, policy meeting of the Federal Open Market Committee on US interest rates and mid-quarter policy review by the Reserve Bank of India (RBI) will dictate near term trend on the bourses.

The market is likely to be volatile this week.

The market is likely to be volatile this week.